The decision to self-insure or rely on a fully insured program is a critical one for businesses of all sizes. It’s a choice that can significantly impact your financial stability, risk management strategies, and administrative processes. This guide delves into the complexities of self-insured vs. fully insured models, exploring the benefits, drawbacks, and considerations that every organization must weigh.

At the heart of this debate lies the fundamental question of risk appetite. Are you comfortable assuming the financial responsibility for potential claims, or do you prefer the safety net of a traditional insurance policy? This article examines the intricacies of each approach, providing a comprehensive overview to help you make an informed decision that aligns with your organization’s unique circumstances.

Definition of Self-Insured and Fully Insured

Self-insurance and fully insured programs are two common approaches to managing risk in various contexts, including employee benefits, property, and liability. While both methods aim to protect against financial losses, they differ significantly in how they handle risk and manage costs.

Self-Insurance

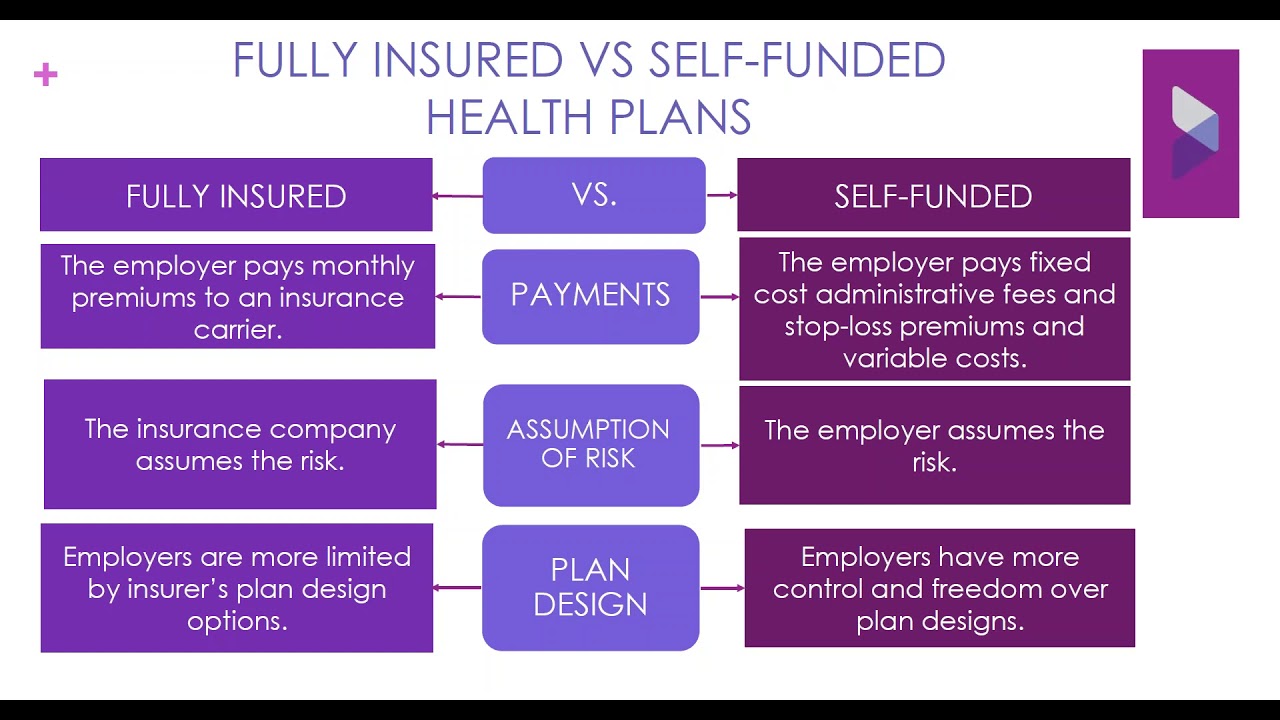

Self-insurance involves assuming the financial responsibility for potential losses without relying on an insurance company. In this model, the organization or individual sets aside funds to cover potential claims.

- Financial Responsibility: The self-insured entity is directly responsible for paying claims, regardless of the size or frequency. This means that they need to have sufficient financial resources to cover potential losses.

- Risk Management: Self-insurance often involves implementing comprehensive risk management strategies to minimize the likelihood and severity of potential claims. This can include safety programs, loss prevention measures, and careful selection of employees or tenants.

- Cost Savings: Self-insurance can potentially lead to cost savings by eliminating insurance premiums and administrative fees. However, it also requires a significant upfront investment in risk management and reserves to cover potential claims.

- Flexibility: Self-insured programs offer greater flexibility in designing coverage and setting claim limits. Organizations can tailor their programs to meet their specific needs and risk profiles.

Fully Insured Programs

In a fully insured program, an insurance company assumes the financial responsibility for covered losses. The insured entity pays premiums to the insurer in exchange for coverage against specific risks.

- Risk Transfer: The core principle of fully insured programs is to transfer the financial risk from the insured entity to the insurance company. This provides protection against catastrophic losses that could otherwise cripple the organization.

- Premium Payments: The insured entity makes regular premium payments to the insurer, which are calculated based on the level of risk and coverage desired. Premiums are typically adjusted annually based on claims history and other factors.

- Claim Handling: The insurance company is responsible for investigating and handling claims, including processing payments and managing legal disputes. This frees up the insured entity to focus on its core operations.

- Predictable Costs: Fully insured programs offer predictable costs, as premiums are fixed for a specific period. However, premiums can fluctuate significantly based on factors such as claims experience and market conditions.

Comparison of Self-Insured and Fully Insured Models

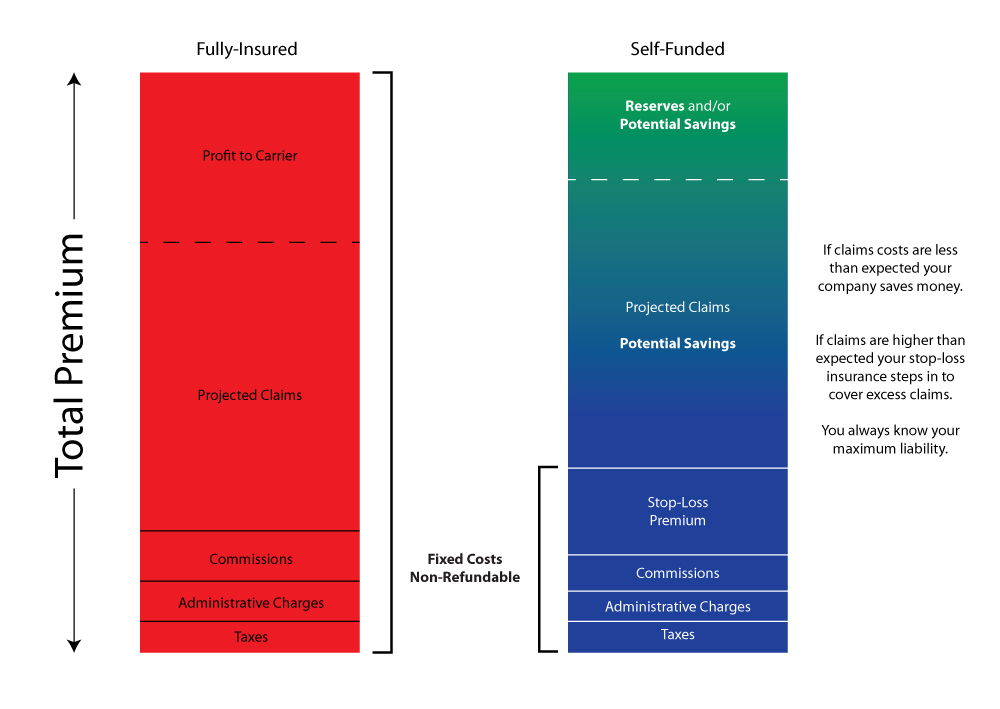

| Characteristic | Self-Insured | Fully Insured |

|---|---|---|

| Risk Transfer | No | Yes |

| Financial Responsibility | Self | Insurance Company |

| Cost Control | High Potential | Limited Control |

| Flexibility | High | Limited |

| Predictability | Less Predictable | More Predictable |

Financial Implications

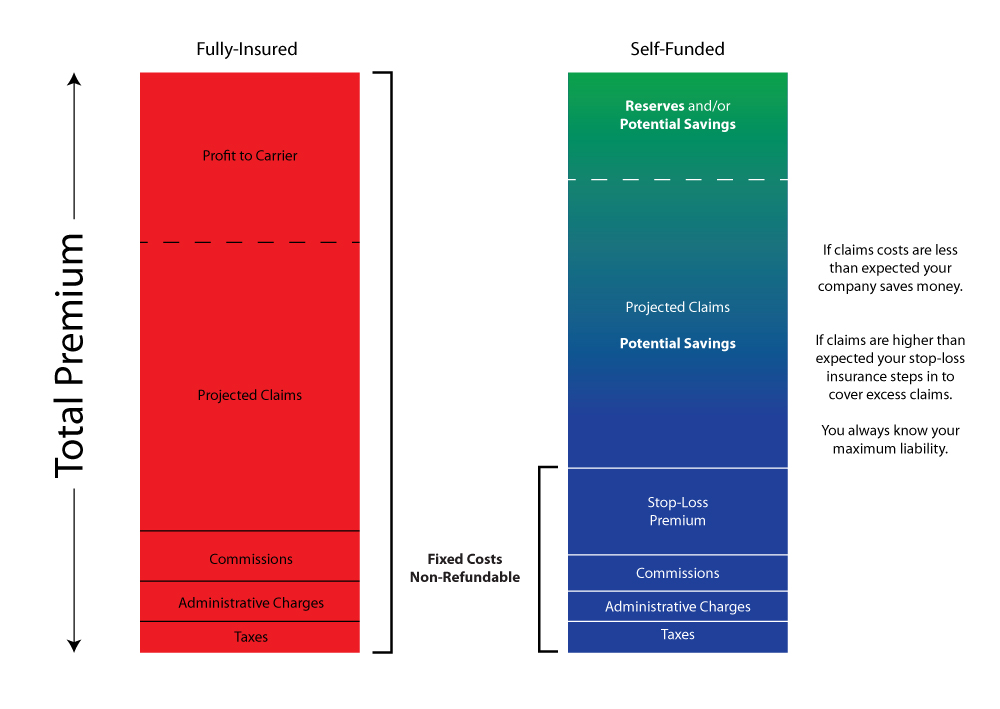

The choice between self-insurance and fully insured programs carries significant financial implications, influencing both potential cost savings and risk exposure. Understanding these financial aspects is crucial for businesses to make informed decisions aligned with their risk tolerance and financial capacity.

Potential Financial Benefits of Self-Insurance

Self-insurance can offer potential financial benefits by allowing businesses to control risk management and potentially reduce costs.

- Cost Savings: Self-insurance can potentially lead to cost savings by eliminating insurance premiums and administrative fees associated with traditional insurance programs. Businesses can retain the funds that would have been paid as premiums, potentially investing them or using them for other purposes.

- Control Over Risk Management: Self-insurance empowers businesses to take a proactive approach to risk management. By assuming responsibility for their own risks, they can implement customized risk mitigation strategies tailored to their specific needs and circumstances.

Potential Risks Associated with Self-Insurance

Self-insurance comes with inherent risks, as businesses bear the full financial responsibility for covered events.

- Significant Financial Losses: Self-insurance exposes businesses to the potential for significant financial losses in the event of a covered event. Without the protection of an insurance policy, they are responsible for covering the entire cost of the event, which could lead to financial strain or even bankruptcy.

- Unforeseen Events: Self-insurance relies on accurate risk assessment and prediction. However, unforeseen events can occur, exceeding the estimated risk levels and leading to substantial financial losses that could have been mitigated with insurance coverage.

- Administrative Burden: Self-insurance requires businesses to establish and manage their own risk management programs, including claim handling and loss control. This can create an administrative burden and require dedicated resources and expertise.

Financial Implications of Fully Insured Programs

Fully insured programs offer a predictable and consistent approach to risk management, with premiums covering potential losses.

- Premium Costs: Fully insured programs involve paying premiums to an insurance company, which covers the cost of potential losses. These premiums are calculated based on the insured’s risk profile, coverage level, and other factors.

Premium costs can vary significantly depending on the specific program and the level of coverage provided.

- Level of Coverage: Fully insured programs offer a defined level of coverage, providing financial protection against covered events. This coverage can include a wide range of risks, such as property damage, liability claims, and employee injuries.

The level of coverage and the specific risks covered are determined by the terms of the insurance policy.

Risk Management

Risk management is a crucial aspect of both self-insured and fully insured programs. It involves identifying, assessing, and mitigating potential risks that could negatively impact an organization’s financial stability and operations. The strategies employed differ significantly depending on the chosen insurance approach.

Risk Management Strategies in Self-Insured Programs

Self-insured programs take a proactive approach to risk management, focusing on strategies that enable them to control and minimize potential losses.

- Risk Assessment: Self-insured programs conduct comprehensive risk assessments to identify and prioritize potential risks. This involves analyzing historical data, conducting risk audits, and evaluating industry trends.

- Risk Mitigation: Once risks are identified, self-insured programs implement mitigation strategies to reduce their likelihood or impact. These strategies can include:

- Loss Prevention: Implementing measures to prevent accidents, injuries, or other events that could lead to claims.

- Loss Control: Developing procedures to minimize the severity of losses once they occur.

- Risk Transfer: Transferring some risks to other parties through methods like excess insurance policies or captive insurance companies.

- Risk Retention: Self-insured programs retain some level of risk, typically for low-frequency, high-severity events, as they believe they can manage these risks more effectively through their own resources.

- Risk Monitoring: Continuous monitoring and evaluation of risk management strategies are essential to ensure their effectiveness.

Risk Management in Fully Insured Programs

Fully insured programs rely heavily on insurance companies to manage their risks.

- Insurance Companies’ Role: Insurance companies provide risk management expertise and resources to fully insured programs. They assess risks, set premiums, and manage claims.

- Risk Transfer: Fully insured programs transfer the majority of their risks to the insurance company through the purchase of insurance policies.

- Risk Pooling: Insurance companies pool risks from multiple policyholders, allowing them to spread the cost of losses across a larger group.

- Risk Mitigation: While insurance companies primarily manage risk through the transfer mechanism, they may also provide risk mitigation advice and services to their policyholders.

Comparison of Risk Management Approaches

| Characteristic | Self-Insured Programs | Fully Insured Programs |

|---|---|---|

| Risk Management Approach | Proactive, focusing on risk assessment, mitigation, and retention. | Reactive, relying on insurance companies to manage risks through transfer. |

| Risk Control | High level of control over risk management strategies. | Limited control, as risk management is delegated to the insurance company. |

| Cost Management | Potential for lower costs in the long term, but higher upfront expenses for risk management programs. | Predictable and consistent costs through premiums, but potentially higher overall costs due to insurance premiums. |

| Financial Stability | More vulnerable to large losses, but can benefit from lower costs if risks are managed effectively. | Greater financial stability due to risk transfer, but potentially higher overall costs. |

Administrative Considerations

The administrative burden of self-insurance and fully insured programs is a key factor in deciding which option is best for an organization. Self-insurance requires a significant investment in resources, while fully insured programs offer a more hands-off approach.

Administrative Burdens of Self-Insurance

Self-insurance necessitates a dedicated team to manage claims processing, risk management, and other administrative tasks. The organization must establish and maintain systems for tracking claims, managing medical providers, and handling legal issues. This can be a complex and time-consuming process, requiring specialized expertise and resources.

Administrative Benefits of Fully Insured Programs

Fully insured programs, on the other hand, benefit from the expertise and resources of insurance companies. Insurance companies have dedicated teams to handle claims processing, risk management, and other administrative tasks. This allows organizations to focus on their core business operations, reducing the administrative burden associated with insurance.

Administrative Complexities of Self-Insured and Fully Insured Programs

The administrative complexities of self-insurance and fully insured programs can be summarized as follows:

| Feature | Self-Insurance | Fully Insured |

|---|---|---|

| Claims Processing | Organization manages claims processing internally. | Insurance company manages claims processing. |

| Risk Management | Organization develops and implements risk management strategies. | Insurance company provides risk management expertise and support. |

| Administrative Staff | Requires dedicated staff to handle administrative tasks. | Minimal administrative staff required, relying on insurance company resources. |

| Cost | Lower premiums but higher administrative costs. | Higher premiums but lower administrative costs. |

Legal and Regulatory Aspects

Navigating the legal and regulatory landscape is a critical aspect of both self-insured and fully insured programs. Understanding the compliance requirements and frameworks governing these programs is crucial for ensuring smooth operations and minimizing legal risks.

Self-Insured Programs

Self-insured programs operate outside the traditional insurance framework and face a distinct set of legal and regulatory considerations. These programs are subject to various federal and state laws, including:

- Employee Retirement Income Security Act (ERISA): ERISA applies to self-insured employee benefit plans, including health plans, and establishes minimum standards for plan administration, fiduciary responsibilities, and disclosure requirements.

- State Insurance Laws: While self-insured programs are not subject to traditional insurance regulations, they may still be subject to state laws governing insurance practices, such as claims handling, solvency requirements, and consumer protection.

- Federal Trade Commission (FTC): The FTC enforces laws against unfair and deceptive business practices, which may apply to self-insured programs in areas like claims handling and marketing.

Self-insured programs must comply with these laws and regulations, including:

- Plan Documentation: ERISA requires detailed plan documents outlining plan provisions, administration, and fiduciary responsibilities.

- Disclosure Requirements: Self-insured programs must provide participants with comprehensive information about their benefits, including plan documents, summaries of material modifications, and annual reports.

- Fiduciary Responsibilities: Individuals managing self-insured plans must act in the best interests of plan participants and beneficiaries, adhering to strict fiduciary standards.

- Claims Handling: Self-insured programs must establish fair and consistent procedures for handling claims, ensuring compliance with state and federal laws.

- Solvency Requirements: While not subject to traditional insurance solvency regulations, self-insured programs must maintain adequate financial resources to cover potential claims and obligations.

Fully Insured Programs

Fully insured programs operate under a traditional insurance framework, where an insurance carrier assumes the risk of covering claims and provides administrative services. These programs are subject to a comprehensive set of legal and regulatory requirements, including:

- State Insurance Laws: Fully insured programs are regulated by state insurance departments, which establish licensing requirements, financial solvency standards, and consumer protection regulations for insurance carriers.

- National Association of Insurance Commissioners (NAIC): The NAIC develops model laws and regulations that states often adopt, providing a degree of uniformity in insurance regulation across the country.

- Federal Laws: Fully insured programs may also be subject to federal laws, such as the Affordable Care Act (ACA), which regulates health insurance markets.

Fully insured programs must comply with these laws and regulations, including:

- Licensing Requirements: Insurance carriers must obtain licenses from state insurance departments to operate and sell insurance products.

- Financial Solvency: Insurance carriers must maintain adequate capital reserves to cover potential claims and obligations, as determined by state regulators.

- Claims Handling: Insurance carriers must establish fair and consistent procedures for handling claims, adhering to state and federal regulations.

- Consumer Protection: Insurance carriers must comply with consumer protection laws, such as requirements for clear and accurate policy disclosures, fair claims handling practices, and consumer grievance resolution processes.

Comparison of Legal and Regulatory Landscapes

| Aspect | Self-Insured Programs | Fully Insured Programs |

|---|---|---|

| Regulation | Subject to a mix of federal and state laws, including ERISA, state insurance laws, and FTC regulations. | Regulated primarily by state insurance departments, with oversight from the NAIC and potential federal law implications. |

| Compliance Requirements | Must comply with ERISA, state insurance laws, and FTC regulations, including plan documentation, disclosure requirements, fiduciary responsibilities, claims handling, and solvency standards. | Subject to state insurance licensing requirements, financial solvency standards, claims handling regulations, and consumer protection laws. |

| Risk Management | Employers bear greater risk for claims and administrative costs, requiring robust risk management strategies. | Insurance carriers assume the risk of covering claims, providing a level of financial protection for employers. |

| Administrative Burden | Higher administrative burden, as employers manage plan administration and claims handling internally. | Lower administrative burden, as insurance carriers handle plan administration and claims processing. |

Suitability for Different Organizations

Choosing between self-insurance and fully insured programs depends on the unique characteristics of an organization. The optimal approach varies based on factors such as size, risk tolerance, financial resources, and industry-specific considerations.

Organizations Well-Suited for Self-Insurance

Self-insurance can be a strategic choice for organizations that possess the necessary financial resources, risk management capabilities, and a robust administrative infrastructure.

- Large Organizations with Significant Financial Resources: Self-insurance is typically more attractive to large organizations with substantial financial reserves to absorb potential losses. These organizations have the capacity to self-fund risks and potentially benefit from lower insurance premiums. For example, Fortune 500 companies often opt for self-insurance due to their financial strength and ability to manage risks effectively.

- Organizations with High Risk Tolerance: Organizations with a higher tolerance for risk may find self-insurance appealing. They are willing to accept the potential for larger financial losses in exchange for the potential for cost savings. For instance, companies operating in industries with a lower frequency of claims, such as manufacturing, might choose self-insurance due to their willingness to manage risk internally.

- Organizations with Strong Risk Management Capabilities: Effective risk management practices are crucial for self-insured organizations. These organizations need to have well-defined risk assessment processes, risk mitigation strategies, and the expertise to manage potential losses. For instance, companies with dedicated risk management departments and a proven track record of managing risk effectively are more likely to consider self-insurance.

- Organizations with Robust Administrative Infrastructure: Self-insurance requires a strong administrative infrastructure to handle claims processing, data management, and compliance requirements. Organizations with established administrative systems and experienced staff are better positioned to manage the complexities of self-insurance. For example, companies with dedicated claims departments and specialized software systems for risk management are more likely to find self-insurance feasible.

Organizations Well-Suited for Fully Insured Programs

Fully insured programs provide a more predictable and straightforward approach to risk management, particularly for organizations with limited resources or a lower tolerance for risk.

- Small to Medium-Sized Enterprises (SMEs): SMEs often lack the financial resources and administrative capacity to effectively manage self-insurance. They may find fully insured programs more convenient and cost-effective, as they can rely on the insurer to handle claims processing and risk management. For example, a small retail business with limited staff and resources may prefer a fully insured program for simplicity and peace of mind.

- Organizations with Low Risk Tolerance: Organizations with a low tolerance for risk may find fully insured programs more appealing. They prefer a predictable and consistent approach to managing potential losses, even if it comes at a higher premium. For instance, a healthcare provider with a high risk of malpractice claims might choose a fully insured program to protect against significant financial losses.

- Organizations with Limited Risk Management Capabilities: Organizations with limited risk management expertise may benefit from fully insured programs. They can leverage the insurer’s experience and resources to manage risk effectively. For example, a start-up company with a limited risk management team may find a fully insured program a valuable option for risk transfer and expert support.

- Organizations with Limited Administrative Resources: Fully insured programs can be more administratively efficient for organizations with limited resources. The insurer handles claims processing, data management, and compliance requirements, freeing up internal resources for other business priorities. For example, a non-profit organization with a small staff may prefer a fully insured program to reduce administrative burdens and focus on their core mission.

Factors to Consider When Choosing Between Self-Insurance and Fully Insured Programs

Organizations need to carefully assess their unique circumstances and consider several key factors before deciding between self-insurance and fully insured programs.

- Financial Resources: Organizations need to evaluate their financial capacity to self-fund potential losses. They should consider their cash flow, reserves, and ability to absorb significant claims. For example, an organization with a large cash reserve and stable financial performance might be better positioned for self-insurance.

- Risk Tolerance: Organizations should assess their willingness to accept the potential for large financial losses. A higher risk tolerance might favor self-insurance, while a lower risk tolerance might favor fully insured programs. For example, an organization with a high risk tolerance for potential losses might consider self-insurance, while an organization with a low risk tolerance might prefer the predictable cost of fully insured programs.

- Risk Management Capabilities: Organizations need to evaluate their internal risk management capabilities, including their expertise in risk assessment, mitigation, and claims handling. Strong risk management capabilities are crucial for self-insurance. For example, an organization with a dedicated risk management department and a proven track record of managing risk effectively might be more likely to consider self-insurance.

- Administrative Capacity: Organizations should consider their administrative infrastructure, including their staff, systems, and processes for claims processing, data management, and compliance. A robust administrative infrastructure is essential for self-insurance. For example, an organization with dedicated claims departments and specialized software systems for risk management might be more likely to find self-insurance feasible.

- Industry-Specific Considerations: Organizations should consider the specific risks and regulations of their industry. Some industries may have a higher frequency or severity of claims, making self-insurance more challenging. For example, healthcare providers might face higher risks of malpractice claims, making fully insured programs more attractive.

Examples and Case Studies

Real-world examples and case studies offer valuable insights into the practical application of self-insured and fully insured programs. By examining the experiences of various organizations, we can gain a deeper understanding of the benefits, challenges, and considerations associated with each approach. This section delves into illustrative examples and case studies, highlighting key outcomes and lessons learned.

Successful Self-Insured Programs

Examples of organizations that have successfully implemented self-insured programs demonstrate the potential benefits of this approach.

- Walmart: The retail giant successfully manages its workers’ compensation program through a self-insured model. By carefully managing risk and implementing robust safety protocols, Walmart has effectively controlled its costs and maintained a high level of employee safety.

- Target: Similar to Walmart, Target also leverages a self-insured model for its workers’ compensation program. Target’s success is attributed to a strong focus on risk management, proactive safety initiatives, and a commitment to employee well-being.

- Self-Funded Health Plans: Many large employers, including Fortune 500 companies, have successfully implemented self-funded health plans. These plans allow organizations to assume greater control over healthcare costs and benefit design, leading to potential savings and improved plan customization.

Transitions Between Self-Insurance and Fully Insured Programs

Case studies examining transitions between self-insurance and fully insured programs provide valuable insights into the factors influencing such decisions and the outcomes of these changes.

- Small Business Transition: A small manufacturing company initially opted for a fully insured program due to its limited resources and lack of expertise in risk management. However, as the company grew, it realized the potential cost savings and increased control offered by self-insurance. After careful planning and risk assessment, the company successfully transitioned to a self-insured model, achieving significant financial benefits and improved risk management capabilities.

- Large Corporation Reassessment: A large corporation with a long-standing self-insured program experienced a series of costly claims, leading to a reassessment of its risk management strategy. The company decided to transition to a fully insured program to mitigate potential financial losses and gain access to broader coverage. This transition allowed the corporation to spread its risk across a larger pool of policyholders, providing greater financial security.

Outcomes and Lessons Learned

Analyzing the outcomes and lessons learned from these examples and case studies highlights the key considerations for organizations when choosing between self-insurance and fully insured programs.

- Risk Management: Self-insurance requires a robust risk management program, including comprehensive risk assessments, effective loss control measures, and strong safety protocols. Organizations need to have the resources and expertise to manage risks effectively.

- Financial Resources: Self-insurance typically requires a significant amount of capital to cover potential claims. Organizations need to have sufficient financial reserves and a strong financial position to manage potential fluctuations in claims costs.

- Administrative Expertise: Self-insurance involves significant administrative responsibilities, including claims processing, risk assessment, and regulatory compliance. Organizations need to have the in-house expertise or access to external resources to handle these tasks effectively.

- Market Conditions: Fluctuations in insurance premiums and the availability of coverage can influence the decision to self-insure or fully insure. Organizations need to carefully analyze market conditions and assess the potential cost savings and risks associated with each approach.

- Regulatory Environment: Regulatory requirements can vary significantly across jurisdictions and insurance lines. Organizations need to carefully consider the legal and regulatory aspects of self-insurance and fully insured programs before making a decision.

Future Trends

The self-insurance and fully insured markets are constantly evolving, driven by technological advancements, changing risk profiles, and evolving regulatory landscapes. These trends present both opportunities and challenges for organizations seeking to optimize their risk management strategies.

Impact of Technology

Technology is transforming the insurance industry, offering new tools and insights to improve risk assessment, pricing, and claims management. This impact is particularly significant for self-insured organizations, as they can leverage technology to enhance their internal risk management capabilities.

- Data Analytics and Predictive Modeling: Advanced analytics and predictive modeling tools enable self-insured organizations to identify and assess emerging risks, optimize risk mitigation strategies, and improve claims forecasting.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being used to automate claims processing, fraud detection, and risk assessment. These technologies can significantly improve efficiency and accuracy, reducing administrative burdens and costs.

- Internet of Things (IoT): IoT devices generate vast amounts of data that can be used to monitor risks and optimize safety practices. For example, telematics devices in vehicles can track driving behavior and identify potential safety hazards.

- Blockchain Technology: Blockchain technology can improve transparency and security in insurance transactions, potentially reducing administrative costs and fraud.

Changing Risk Profiles

The global landscape is marked by increasing volatility and uncertainty, leading to shifts in risk profiles across industries. These changes present both opportunities and challenges for organizations considering self-insurance or fully insured programs.

- Cybersecurity Threats: Cyberattacks are becoming increasingly sophisticated and widespread, posing significant risks to organizations of all sizes. Self-insured organizations need to invest in robust cybersecurity measures and consider cyber risk insurance to mitigate potential losses.

- Climate Change: The effects of climate change, such as extreme weather events and rising sea levels, are increasing the frequency and severity of natural disasters. Organizations in vulnerable regions need to carefully assess their exposure to climate-related risks and consider appropriate insurance coverage.

- Emerging Technologies: Rapid technological advancements create new risks and opportunities. Self-insured organizations need to stay informed about emerging technologies and their potential impact on their operations and risk profiles.

Evolving Regulatory Landscape

The regulatory environment surrounding insurance is constantly evolving, with new laws and regulations being introduced to address emerging risks and consumer protection concerns.

- Data Privacy and Security: Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are increasing the focus on data privacy and security. Self-insured organizations need to ensure they comply with these regulations to avoid penalties and maintain customer trust.

- Environmental, Social, and Governance (ESG) Factors: ESG factors are becoming increasingly important for investors and stakeholders. Self-insured organizations need to consider the ESG implications of their risk management practices and demonstrate their commitment to sustainability.

- Insurtech: The rise of insurtech companies is disrupting the traditional insurance market. These companies are leveraging technology to offer innovative products and services, often at lower costs. This competition is forcing traditional insurers to adapt and innovate, which can benefit both self-insured and fully insured organizations.

Key Considerations for Navigating Future Trends

Organizations considering self-insurance or fully insured programs need to carefully evaluate the evolving trends in the market and adjust their strategies accordingly.

- Technology Adoption: Embrace technology to improve risk management, claims processing, and data analytics. Invest in solutions that enhance efficiency, accuracy, and insights.

- Risk Assessment and Mitigation: Proactively identify and assess emerging risks, such as cybersecurity threats, climate change, and technological disruptions. Implement appropriate risk mitigation strategies to minimize potential losses.

- Regulatory Compliance: Stay informed about evolving regulatory landscapes, including data privacy, cybersecurity, and ESG factors. Ensure compliance with all applicable regulations to avoid penalties and maintain customer trust.

- Strategic Partnerships: Collaborate with insurers, technology providers, and other stakeholders to access expertise, innovation, and resources. Consider forming strategic partnerships to leverage complementary capabilities and achieve mutual benefits.

Key Considerations for Choosing Between Self-Insurance and Fully Insured Programs

Choosing between self-insurance and a fully insured program requires careful consideration of various factors. Both approaches offer distinct advantages and disadvantages, and the optimal choice depends on the specific circumstances of the organization. This section will delve into the key considerations that should guide this decision-making process.

Advantages and Disadvantages

A comprehensive understanding of the advantages and disadvantages of each approach is crucial for making an informed decision. The following table Artikels the key considerations:

| Factor | Self-Insurance | Fully Insured |

|---|---|---|

| Cost | Potentially lower premiums in the long term, but subject to significant fluctuations based on claims experience. | Predictable and stable premiums, but potentially higher overall costs in the long run. |

| Risk | Higher risk exposure as the organization assumes responsibility for all claims. | Lower risk exposure as the insurer bears the financial burden of claims. |

| Administration | Requires significant administrative resources and expertise to manage claims and risk. | Minimal administrative burden as the insurer handles claims and risk management. |

| Legal Considerations | Subject to regulatory scrutiny and potential legal liabilities. | Greater legal protection as the insurer typically assumes legal responsibility for claims. |

Questions for Evaluation

Organizations should consider the following questions when evaluating their insurance coverage options:

- What is the organization’s risk tolerance and financial capacity to absorb potential losses?

- What are the anticipated claims costs and frequency for the organization’s specific risks?

- Does the organization have the necessary administrative resources and expertise to manage a self-insurance program?

- What are the potential legal and regulatory implications of self-insurance?

- What are the long-term cost implications of each approach, considering potential fluctuations in claims experience?

- What are the potential benefits and drawbacks of each approach in terms of risk management and control?

- What are the available resources and support systems for each approach?

Final Wrap-Up

Ultimately, the choice between self-insurance and fully insured programs hinges on a nuanced assessment of your organization’s risk tolerance, financial capacity, and administrative capabilities. By carefully considering the factors discussed in this guide, businesses can make an informed decision that optimizes their risk management strategies and ensures long-term financial stability.